To succeed in the stock market, what is necessary? Many investors spend hours in front of their computers, analyzing charts to find the optimal buying and selling timings. However, recent research once again highlights how difficult it is to time the market.

According to this research, only 9 trading days accounted for all the gains in the 2024 stock market. What about the remaining days? During the other 96.9% of trading days, the net return of the market was virtually zero. This surprising fact implies that the average day trader had a very low chance of being in the market during these 9 trading days.

The Importance of Just 9 Trading Days

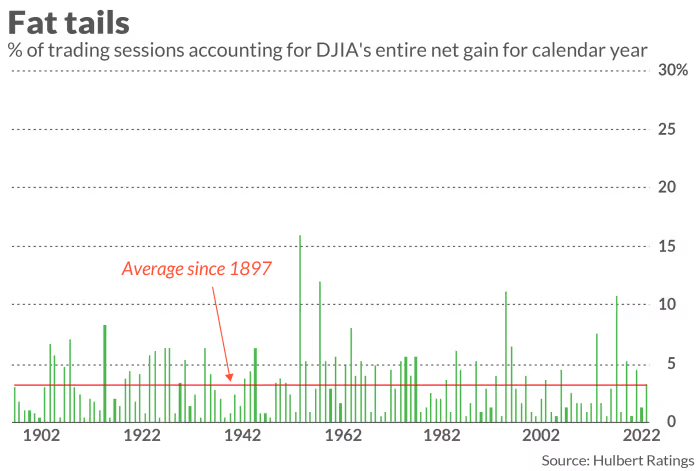

Do you think this year is special? In fact, this year is not unique. The chart below shows the percentage of days responsible for the entire annual return or loss in the stock market. Since 1897, the average has been just 3.1%, meaning the net return for the remaining 96.9% of trading days is zero.

A similar phenomenon occurred in 2020. The Dow Jones recorded an annual return of 7.2%. Excluding the best day, March 24, the Dow would have made no profit that year.

Skewed Distribution of Returns

This distribution is similar for individual stocks. An analysis of all listed stocks globally (about 64,000) from 1990 to 2020 showed that 1,526 stocks (2.39%) were responsible for all the wealth created in the global stock market during that period. The net assets created by the remaining 97.61% of stocks were zero.

Implications for Investment Strategy

What lessons can we learn from this research? It suggests that buying and holding a broad index fund is advantageous. Because it’s impossible to predict which stocks will be part of the small subset that generates long-term market returns, you may lag behind those index funds. The same goes for day traders. Attempting to pick the few days that account for the market’s net returns is extremely challenging.

Conclusion

The safest way to succeed in the stock market is through long-term investment via index funds. It might be wiser to participate in the market with a long-term perspective rather than chasing short-term gains through day trading.

If you found this article helpful, remember it when making your next investment decision. Buying and holding a broad index fund might be the path to success in the stock market.

Reference: MarketWatch, “The stock market’s entire return rests on a surprisingly small number of days”