The stock market is constantly fluctuating. In 2023, the S&P 500 index rose by more than 26% and continues its upward trend this year. While this is great news for investors, it’s important to remember one crucial fact: It’s precisely when things are going well that you should prepare for losses.

1. Minsky’s Financial Instability Hypothesis

Hyman Minsky explained in the early 1990s how economic prosperity could lead to instability through his ‘Financial Instability Hypothesis.’ According to his research, prolonged economic booms make investors take on more risk, eventually leading to economic instability. The end of a boom doesn’t necessarily require bad news; even a reduction in good news can be enough to lead to a downturn.

During prolonged prosperity, the economy transitions from financial relations that create a stable system to financial relations that create an unstable system.

Hyman Minsky

2. Current Market Conditions and Warning Signs

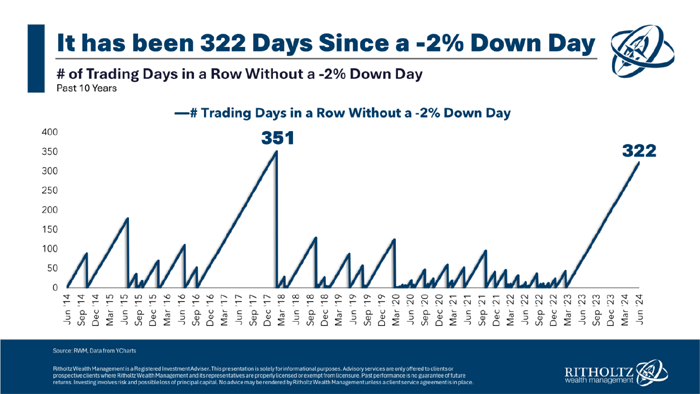

By the end of May this year, the S&P 500 index had set 24 all-time highs. Volatility is low, and the S&P 500 has not had a 2% drop in over 300 trading days. This situation is close to the longest record of no significant drops in ten years.

So, is now the time to prepare for losses? The answer is simple.

Yes.

3. Investment Strategy: Managing Emotions and Expectations

Ask yourself if you would be satisfied with your current asset allocation if the market experienced a sharp sell-off or if the bull market continued. It’s important to manage your emotions and avoid getting swept up in crowd mentality. Lowering your expectations is also a good strategy. By lowering your return expectations, you’re more likely to stick to your plan when things get tough or when greed takes over.

- Manage your emotions considering market volatility.

- Lower your return expectations and set realistic plans.

- Diversify your investments across various assets to reduce risk.

Conclusion: Invest with a Long-Term Perspective

The key to investing is maintaining a long-term perspective and not getting swayed by short-term volatility. The stock market goes through cycles of ups and downs, but over the long term, it tends to rise. Therefore, it’s essential to invest consistently with long-term goals in mind.

Now, while the market is rising, is the time to prepare for losses. Remember Minsky’s Financial Instability Hypothesis, manage your emotions and expectations well, and invest with a long-term perspective. This way, you can maintain stable investments regardless of market conditions.

References: A Wealth of Common Sense, “The Minsky Market”