Many companies are increasingly relocating their headquarters to places with no or very low taxes. These locations, often referred to as “tax havens,” offer zero or very low corporate tax rates, making them highly attractive to businesses. Below, we take a closer look at these tax havens.

Definition and Importance of Tax Havens

A tax haven is a country or region where corporate tax rates are low or non-existent. By relocating their headquarters to these locations, companies can significantly reduce their tax burden. This plays a crucial role in reducing corporate expenses and maximizing profits.

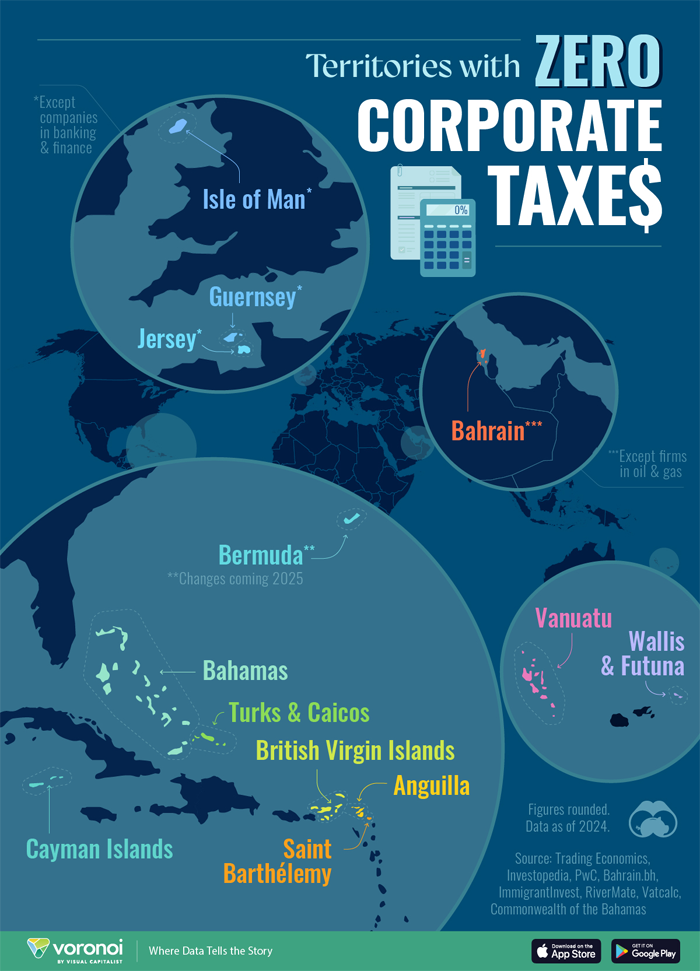

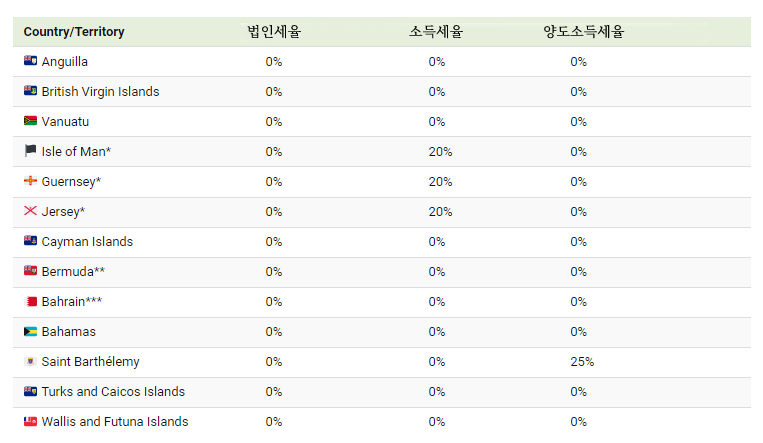

Distribution of Tax Havens

Most tax havens are small island nations in the Caribbean, Pacific, and British Isles. These include Bermuda, the Cayman Islands, and the Bahamas.

- Bahrain: There is no corporate tax unless the company operates in the oil and gas sector, in which case a 46% tax rate applies.

- British Crown Dependencies: Banks and financial companies are subject to a 10% corporate tax rate, and taxes are also levied on property income, marijuana industries, and retail businesses with taxable profits over £500,000.

- Bermuda: A 15% corporate tax will be introduced in 2025, but only for companies that are part of multinational groups with annual revenues exceeding $800 million.

International Response

The OECD has proposed a minimum corporate tax rate of 15% to reduce the incentives for using tax havens. This allows for a “top-up tax” to be applied in other jurisdictions if a country’s corporate tax rate falls below this minimum threshold, enabling other countries to recapture tax revenues.

Conclusion

While tax havens remain an attractive option for companies, international regulations and new laws are changing the landscape. Companies may opt for tax havens to reduce their tax burden and maximize profits, but the sustainability of this strategy depends on future international responses.

The reason companies choose tax havens is clear: to minimize taxes and maximize profits. However, whether this strategy will remain viable depends on the ongoing international response.

Source: Visual Capitalist, “Mapped: A Short Overview of Places With Zero Corporate Taxes”