When discussing the stock market, many people talk about how rapidly it changes. However, the important point to note is that the stock market, in essence, has not fundamentally changed. Let’s explore why this is the case.

The Stock Market: Past vs. Present

Through Charlie Ellis’s book, *The Index Fund Revolution*, we learn how Wall Street has evolved over the past 50 years. In the past, it was rare to find MBA or Ph.D. holders, trades were conducted on paper, and messengers carried stock and bond certificates. Today, institutional and high-frequency trading (HFT) dominate individual trades. More than 98% of transactions on the New York Stock Exchange (NYSE) are conducted by institutions and HFT.

Moreover, with the advent of Bloomberg terminals, algorithmic trading, and quantitative analysts, the market has become more complex. A global integrated market has been formed, and crucial investment information is now available to all investors simultaneously. These changes have made the stock market more transparent and fair.

The Unchanging Nature of the Stock Market

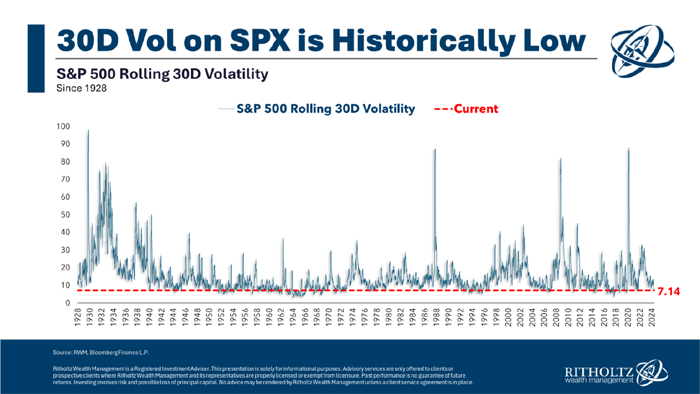

So, has the stock market really not changed? The answer lies in human nature. Looking at the standard deviation of the S&P 500 index’s 30-day returns since 1928, we can see that volatility in the stock market has always been present. Whether during the Great Depression, the 1987 crash, the financial crisis, or the COVID-19 pandemic, volatility has remained consistent.

This means that the unchanging nature of the stock market is tied to human emotions—fear, greed, panic, euphoria, anxiety, and FOMO (Fear Of Missing Out). As long as human emotions remain unchanged, so too does the essence of the stock market.

Our Response to the Stock Market

Now that we understand the stock market’s unchanging nature, how should we respond?

- Maintain a Long-Term Perspective: It’s crucial to maintain a long-term perspective and not be swayed by short-term volatility.

- Diversify Across Different Assets: To reduce risk, diversify investments across different asset classes rather than focusing on just one.

- Avoid Emotional Responses: Avoid emotional responses, which are a natural part of human behavior in the stock market, and instead make decisions rationally.

Conclusion

The stock market is volatile, which underscores that its essence does not change. As long as human emotions remain constant, so too will the stock market. Recognizing this, it’s important to develop a long-term investment strategy that avoids emotional responses.

References: A Wealth of Common Sense, “The Stock Market Never Changes”