When discussing investment strategies, the term “economic moat” frequently comes up. This concept, popularized by Warren Buffett, refers to a company’s ability to protect itself from competitors and generate high profits over the long term. Understanding and utilizing an economic moat is a key to successful investing.

What is an Economic Moat?

An economic moat refers to the competitive advantage that allows a company to maintain a consistently high return on invested capital (ROIC). Simply put, it’s like a ‘moat’ around a company’s ‘castle’ to protect it from competitors. The wider and deeper the moat, the harder it is for competitors to invade. For example, Coca-Cola’s brand value or Google’s search algorithm are strong examples of economic moats.

An economic moat is a powerful shield that ensures a company’s long-term success.

Why is an Economic Moat Important?

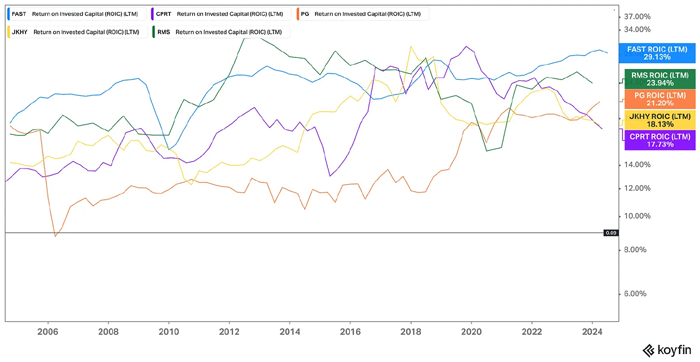

The importance of an economic moat is straightforward. A company must maintain an ROIC that exceeds its cost of capital to continuously create shareholder value. For example, if a company generates a 20% ROIC annually, it consistently earns returns that exceed its cost of capital, typically around 9%.

- Long-term competitive advantage: A moat allows a company to stay ahead of its competitors in the long run.

- Stable profit generation: Companies with economic moats are more likely to generate stable profits.

- Increased shareholder value: High ROIC leads to continuous growth in shareholder value.

We can find various forms of economic moats across different industries. For example, Fastenal has a strong competitive advantage in supply chain management and logistics, contributing to its high ROIC over the past 20 years. Another example is P&G, which secures high consumer loyalty through its diverse range of consumer goods brands.

How to Analyze an Economic Moat

Analyzing an economic moat is not simple, but it can be approached through several key factors. These include identifying the source of the moat, assessing its breadth and duration, and determining whether it is being strengthened over time. Additionally, the management’s ability to widen the moat is a crucial factor.

Analyzing the source and sustainability of a moat is key to any investment strategy.

Conclusion: The Importance of an Economic Moat

Not every investor needs to focus solely on companies with economic moats. However, for those pursuing long-term investment strategies, understanding and analyzing economic moats is vital. Companies with economic moats are more likely to generate stable and high returns in the long run.

Lastly, when investing in companies with economic moats, it’s essential to carefully evaluate whether the company can maintain its sustainable competitive advantage over time. This approach helps minimize investment risks and achieve stable returns.

Reference: Flyover Stocks, “Economic Moats Explained: What They Are & Why They Matter – Part I”