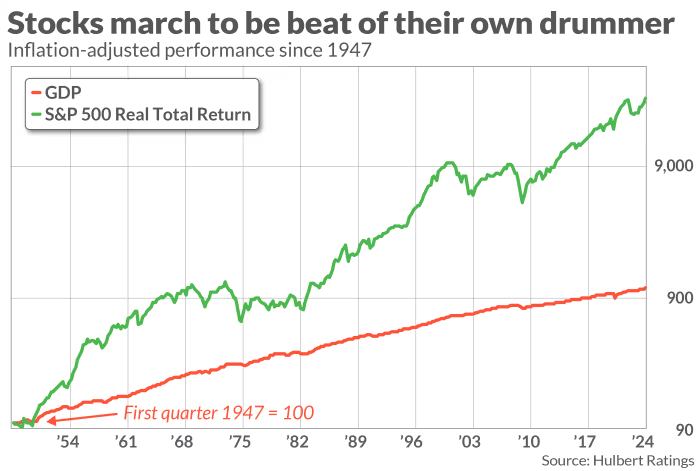

Understanding the relationship between the stock market and the economy is a challenging task for anyone. However, the stock market responds more sensitively to two indicators that are more crucial than economic growth rates. You too can enhance your investment strategy by focusing on these two indicators. For investors, GDP is not the most important factor. In this article, we will explore two indicators that significantly impact the stock market: interest rate trends and investor sentiment.

Interest Rate Trends: The Hidden Key to the Stock Market

Interest rates are a crucial factor that directly impacts the stock market. When interest rates are low, companies can expand investments with cheaper capital, positively influencing the stock market. Conversely, when interest rates rise, the cost of investment for companies increases, which negatively affects stock prices. Changes in interest rates are a key indicator for predicting stock market volatility.

For example, when the Federal Reserve raises interest rates, the stock market tends to decline. This is because corporate borrowing costs increase, and consumer spending decreases. On the other hand, lowering interest rates stimulates economic growth and drives stock prices up.

Investor Sentiment: The Invisible Force Driving the Market

Investor sentiment also significantly impacts the stock market. The emotions of investors are a critical factor in determining the direction of the market. Investors view the market through economic indicators, news, and political events, leading to shifts in sentiment. Positive news instills confidence in investors, prompting them to buy stocks, while negative news leads them to sell off and minimize losses.

For instance, at the onset of the COVID-19 pandemic, market anxiety surged, leading to a sharp drop in stock prices. However, as government fiscal policies and vaccine development news emerged, investor sentiment recovered, and stock prices rebounded. This demonstrates the crucial role of investor sentiment.

Conclusion: More Important Than GDP Are Interest Rates and Sentiment

In conclusion, the stock market reacts more sensitively to interest rate trends and investor sentiment than to GDP growth rates. The impact of GDP growth on stock prices is minimal. Therefore, when investing in stocks, it is essential to focus on interest rates and investor sentiment. This will help you make better investment decisions.

There are various ways to assess interest rates and investor sentiment. Keep an eye on economic news and Federal Reserve announcements, and utilize various indicators to gauge market sentiment. You can achieve successful investing too. Start now!

Reference: MarketWatch, “Your stocks don’t care about the overall economy. These 2 gauges matter more.”