The stock market is always volatile. So, how can one consistently generate profits in such a market? Recent research by Professor William Goetzmann from Yale University, along with Professors Akiko Watanabe and Masahiro Watanabe from the University of Alberta, has provided an answer to this question. Their study revealed that procyclical stocks could offer higher returns over the long term.

What Are Procyclical Stocks?

Procyclical stocks are those that tend to experience significant declines during economic downturns. These stocks offer higher long-term returns to compensate investors for the risks of losses during recessions. In other words, procyclical stocks don’t just outperform during booms; they also deliver above-average returns over the long term.

This theory was first proposed by MIT’s Professor Robert Merton, who won the Nobel Prize in Economics in 1997. Professor John Cochrane from Stanford University summarized Merton’s theory as follows:

Procyclical stocks, which perform well during booms but poorly during recessions, are expected to have higher average returns than defensive stocks that perform well during downturns.

Contribution of the New Research

The research by Professors Goetzmann and Watanabe provides important empirical support for this theory. They discovered that procyclical stocks consistently deliver higher returns independently of other factors like size, value, or momentum. This finding suggests that procyclical stocks could offer new opportunities for investors.

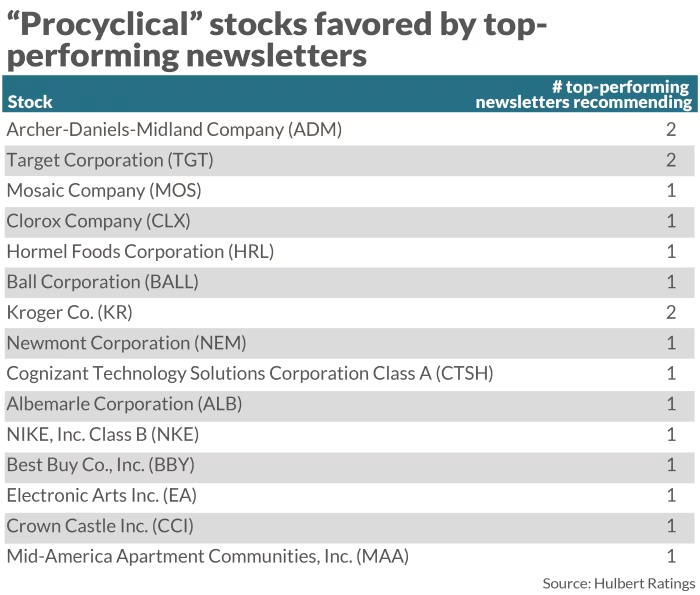

The researchers identified procyclical stocks using S&P 500 index data and 25 years of GDP data. They found that the most procyclical stocks provided higher long-term returns.

Investment Strategy

So, how can you invest in procyclical stocks?

- First, regularly review economic data to identify procyclical stocks.

- Second, adopt a long-term investment strategy to take advantage of economic cycles.

- Third, continuously update and analyze information on procyclical stocks.

Procyclical stock investment is suitable for investors who can withstand short-term losses. However, it can be a powerful strategy that provides higher returns in the long run.

Conclusion

There are many strategies to succeed in the stock market, but investing in procyclical stocks offers new possibilities. For investors seeking higher long-term returns, this new research suggests that it might be worth considering an investment in procyclical stocks.

Reference: Market Watch, “A new way of picking market-beating stocks”