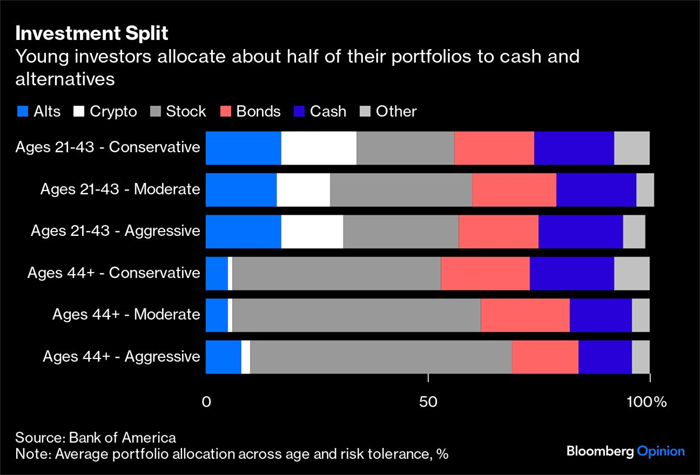

Young investors have recently shown a growing interest in alternative investments. They are turning to new investment avenues like watches, sneakers, and rare cars instead of traditional stocks and bonds. But is this choice truly wise?

Reasons for the Appeal of Alternative Investments

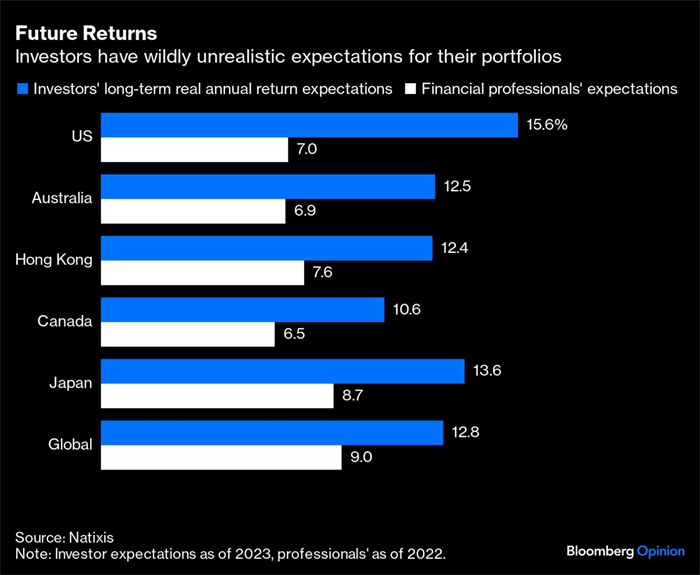

According to a Bank of America (BofA) survey, 94% of millennials and Gen Z are inclined to invest in collectibles. This trend seems to stem from dissatisfaction with traditional investment methods. Young investors who feel that stocks and bonds are not providing sufficient returns are seeking new investment opportunities.

The Appeal and Risks of Alternative Investments

Alternative investments have a different appeal compared to traditional stocks and bonds. For example, collectibles like watches or rare cars come with unique stories and can provide joy in ownership. However, not all assets are safe. Stocks and bonds offer high liquidity and the ability to diversify through index funds, making them relatively safer, whereas alternative assets like collectibles have high price volatility and are difficult to predict.

- Stocks and bonds: High liquidity, diversifiable through index funds.

- Collectibles: Contain unique stories but have significant price volatility.

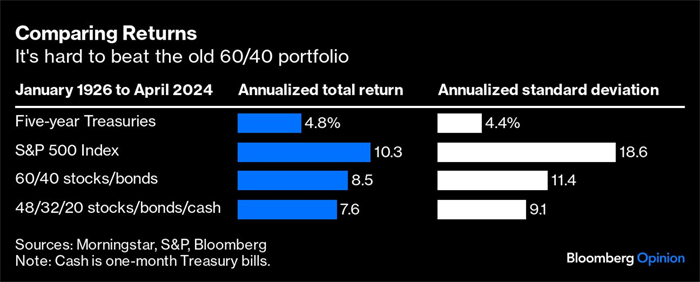

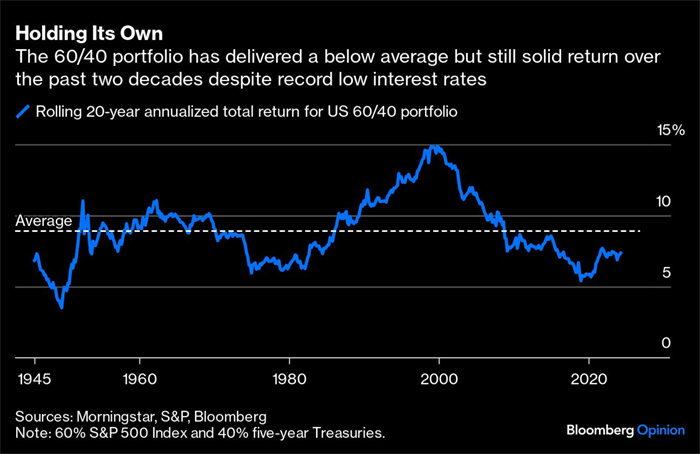

The Strengths of Traditional Investments

The traditional 60/40 portfolio has recorded stable returns over a long period. This portfolio, which has provided an average annual return of 8.5% from 1926 to last April, offers long-term stability through a balanced allocation between stocks and bonds. This return rate is attractive to most investors.

The Reality of Alternative Investments

It is understandable why young investors might prefer alternative investments, but expecting better returns from these is not realistic. Although there are some exceptional cases, like Yale University’s endowment management, most investors can achieve more stable returns through traditional investment methods.

Conclusion: Rethinking Alternative Investments

Young investors may obtain a lot of information from platforms like social media, but for long-term stable returns, they should focus more on traditional investment methods. Alternative investments can be attractive, but the associated risks must be carefully considered.

Source: Bloomberg, “Gen Z’s Alternative Investing Bug Will Cost Them Dearly”