In the investment world, the metaphor of the “broken clock” is often heard. This metaphor highlights the difficulty of market predictions and reflects the ongoing debate between bears (pessimists) and bulls (optimists). However, to achieve successful investing, it is essential to move beyond this binary thinking. In this article, we will explore the fallacy of the “broken clock” and explain the importance of contrarian investment strategies.

The Fallacy of the “Broken Clock”

The Conflict Between Bears and Bulls

Some people say that bears are like a “broken clock” that is right twice a day. While this may seem true during bull markets, in reality, both bull and bear markets fall into this fallacy. If bears are right twice a day, then bulls must be wrong twice a day.

The Importance of Timing in Investment

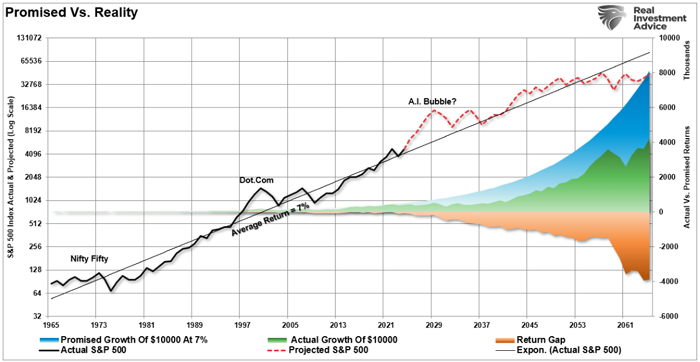

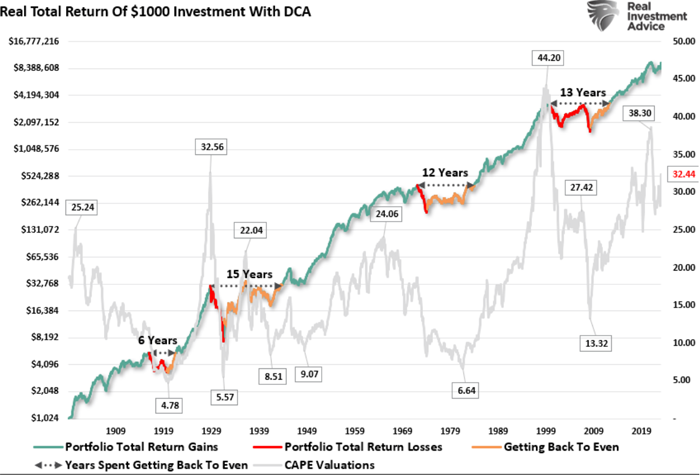

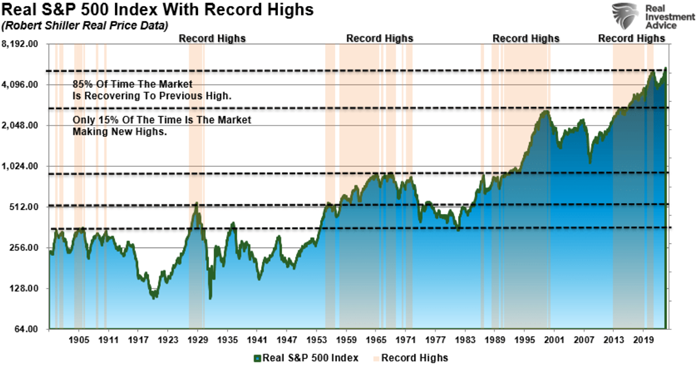

In the game of investing, “wrong” timing is crucial for long-term goals. There is a significant difference between the average return on capital and the actual return. Because a loss in a particular year can erase the effect of compound interest over the years, timing in investment is a decisive factor.

Promises vs. Reality

The Reversal of Market Cycles

Historically, bull market cycles only account for half of the entire market cycle. This is because, during every bull market cycle, the market and economy accumulate excesses that are reversed in the following bear market. As Isaac Newton said, what goes up must come down.

The Mistakes of Bulls

During bull markets, bears are often the subject of ridicule. However, bulls also make mistakes at the worst times. For example, few people remember Jim Cramer’s top 10 stock picks in March 2000 or the bullish media analysts who kept saying “buy” throughout the 2008 crisis. Yet, their buy recommendations were remembered as correct, even though they were issued at times when almost no investor had capital left.

The Art of Contrarianism

The Problem of Emotional Bias

The biggest problem for investors is emotional bias. Choosing between being a bull or a bear can cloud our perception of risk. The most critical factor is “confirmation bias,” where individuals seek confirmation and ignore data that does not support their views.

A Balanced Approach

As investors, we must be open to all data. And evaluate the incoming data while assessing the risks inherent in our portfolios. This risk assessment should be a public analysis of our current positioning compared to the market environment.

Portfolio Management

As portfolio managers, it is essential to invest in a way that generates short-term returns while minimizing the potential for catastrophic losses that could negate years of growth. You cannot be solely a bull or a bear.

Conclusion: The Path of a Contrarian Investor

Overcoming Emotional Bias

Being a contrarian investor can be a difficult and lonely path, but it can lead to successful investing. The key is to avoid crowd psychology, conduct thorough research to avoid confirmation bias, and establish a sound long-term investment strategy that includes risk management.

Investment Principles

- Avoid “herd mentality,” where you pay increasingly higher prices without rational reasoning.

- Avoid “confirmation bias” through thorough research.

- Establish a sound long-term investment strategy that includes “risk management” protocols.

- Diversify portfolio allocation models to include “safer assets.”

- Control “greed” and resist the temptation to get rich quickly through speculative investments.

- Avoid getting stuck on “what could have been” or being “fixated” on past values.

- Recognize that price inflation does not continue indefinitely.

The most important thing in investing is to avoid emotional bias and maintain a balanced perspective. By doing so, you can achieve stable and sustainable returns in the long run. I hope this article inspires you to walk the path of a contrarian investor.

References: Real Investment Advice, “The “Broken Clock” Fallacy & The Art Of Contrarianism”