Investing often brings regrets, and a balanced portfolio is a common source of these feelings for many investors. Why is that? Let’s explore this through a scenario from five years ago.

Investment Scenario from 5 Years Ago

There was an investor with a relatively conservative approach who decided to split investments between stocks and bonds instead of holding cash. The portfolio was evenly split, with 50% in stocks and 50% in bonds.

How did this portfolio perform after five years?

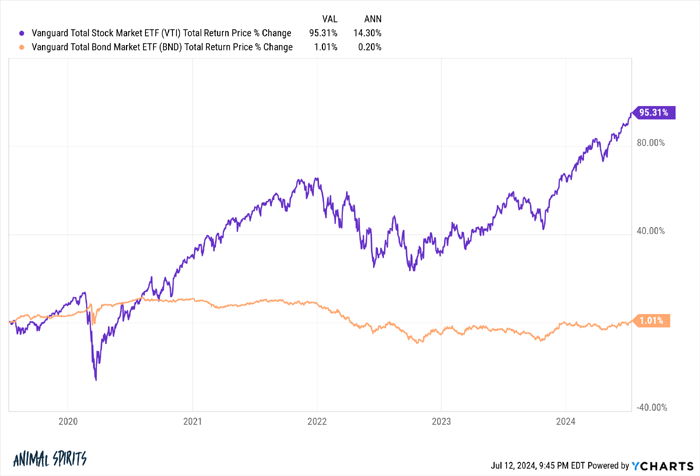

Stocks more than doubled in value, experiencing drops of 35% and 25% along the way, but eventually delivering over 14% annual returns. Bonds, on the other hand, suffered nearly 20% declines and barely produced any gains. The reward for taking on stock risk was substantial, while the performance of bonds was disappointing.

The Role and Importance of Bonds

Criticism of bonds is easy, but they play a crucial role even with lower expected returns than stocks. Bonds help maintain portfolio stability, especially when stock market volatility is high. In recent years, there has been a historically severe bond bear market, causing significant pain for investors. However, current rising interest rates have pushed bond yields to 5.1%.

Strategies to Reduce Regrets

Maintaining a balanced portfolio is an important strategy to minimize regrets. Diversifying with a 50-50 split between stocks and bonds can help avoid extreme regrets. While you might regret not increasing your stock allocation when markets rise, or regret not reducing your bond allocation, balance can keep these feelings in check.

Vanguard’s founder, John Bogle, also advocated for a 50-50 split between stocks and bonds in his portfolio. He once said:

I spent half my time wondering why my stocks grew so large, and the other half wondering why they shrank so much.

This quote illustrates that even with a balanced portfolio, regrets can still accompany investors.

Conclusion

The key to investing is not driving by looking in the rearview mirror. Relying solely on past performance to predict the future is not useful. Instead, balancing stocks and bonds in your portfolio is a strategy to minimize regrets.

Regret is inevitable in investing, but a balanced portfolio is a strategy to avoid extreme regret. Diversify your investments between stocks and bonds to reduce regrets and aim for stable performance.

Reference: A Wealth of Common Sense, “A Balanced Portfolio Always Comes with Regrets”