Warren Buffett’s investment philosophy is simple yet profound. According to him, great companies growing slowly like turtles can actually be a powerful strategy. This might sound contradictory at first. Most of us believe that fast-growing companies are the ones that succeed. However, Buffett uses the case of See’s Candies to demonstrate that substantial wealth can be generated even through slow growth.

See’s Candies: Slow but Solid Growth

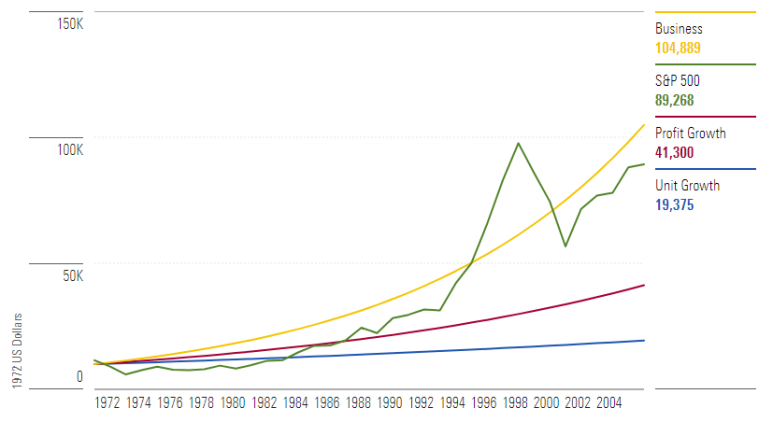

See’s Candies was acquired by Berkshire Hathaway in 1972. At the time, this company was not widely recognized by the public and had not caught the attention of many investors. However, Buffett saw the potential in this company, and his intuition was correct. Although See’s Candies only increased its annual candy production by an average of 1.9%, this small growth accumulated over time to bring enormous returns to Berkshire shareholders.

The secret to this company’s success was simple. See’s Candies raised its candy prices slightly every year, but the rate of price increase was just above the inflation rate. This simple strategy made a significant difference over time, quadrupling See’s Candies’ real pre-tax profits.

The Power of Consistency: Lessons from See’s Candies

The case of See’s Candies differs from the investment strategies we usually think of. Most investors aim for rapid growth, expecting the kind of sharp growth and high returns that tech companies often promise. However, See’s Candies shows how consistent profitability can be achieved even with slow growth.

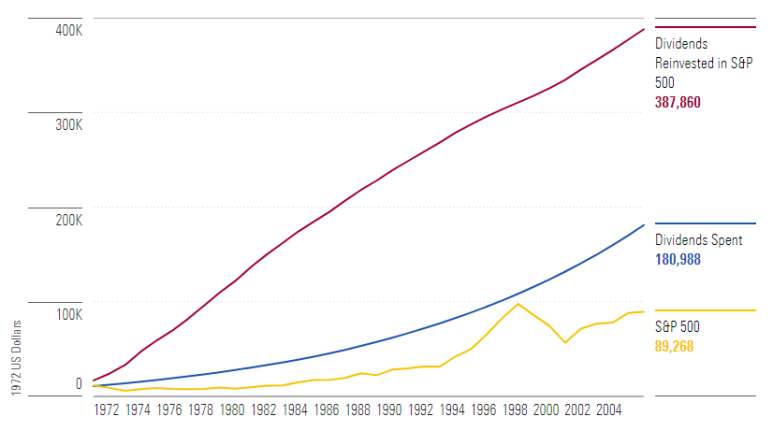

One reason this company was able to succeed was its efficient use of capital. See’s Candies reinvested very little of its pre-tax profits, instead channeling most of its earnings into Berkshire Hathaway’s coffers. If this company had been publicly traded, those profits would have been distributed as dividends, allowing investors to gain additional returns from those dividends.

Learning from Warren Buffett’s Investment Philosophy

Warren Buffett’s investment philosophy emphasizes that it is more important to endure over time than to advance quickly. The case of See’s Candies illustrates this well. Rapid growth is undoubtedly attractive, but in the long run, steady and stable growth can yield more valuable results.

How can we apply Buffett’s philosophy to our investments? Rather than focusing on short-term results, we should invest in companies that can create sustainable value over the long term. This approach may take time, but it will ultimately bring solid returns.

Try It Yourself: A New Perspective on Growth

The story of See’s Candies offers us a valuable opportunity to rethink our investment strategies. Pause for a moment from the rush to grow quickly and consider the power of steady growth. In the long term, the turtle can indeed beat the hare. If you’ve been inspired by Warren Buffett’s success, consider redefining your investment philosophy.

Reference: MorningStar, “A Great Company That’s a Turtle, Not a Hare”