Making money efficiently—doesn’t that sound appealing? In fact, this phrase encompasses a very important concept in business. While we often say we “make money,” there’s a significant difference between simply earning money and “minting money.” So, what does it mean to mint money effectively?

The Importance of Free Cash Flow

Minting money effectively means more than just generating profits. The key concept here is Free Cash Flow (FCF). Free Cash Flow is the cash that remains after a company covers its essential capital expenditures. This money can be used for investments, paying off debt, or distributing dividends to shareholders.

One of the most critical metrics for determining a company’s success is this Free Cash Flow. If you’re considering investing in a company, you can assess how well it “mints money” by looking at its Free Cash Flow.

The Difference Between a Traditional Restaurant and a Trendy Eatery

To illustrate this point, let’s consider an example. A traditional cold noodle restaurant like Eulmildae has been generating stable profits for a long time without investing in flashy interiors or special equipment. This establishment can confidently expect to earn a consistent income each year. On the other hand, a trendy new eatery might generate substantial profits in its early years but will eventually need to reinvest in interior design and make new investments to keep customers interested.

As a result, Eulmildae is likely to maintain stable Free Cash Flow over time, while the trendy restaurant will face ongoing investment demands and greater uncertainty about future profits. This difference highlights the varying abilities to “mint money.”

Warren Buffett’s Apple Investment Case

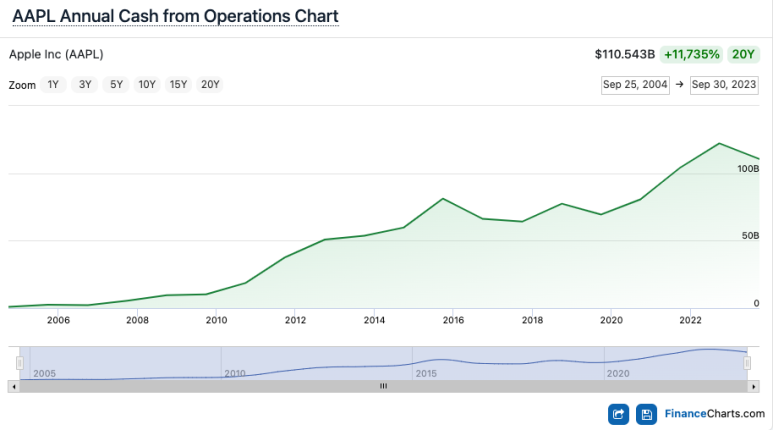

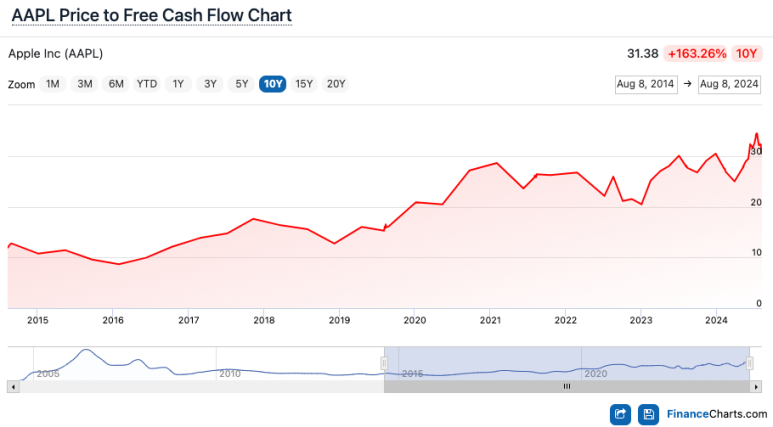

Warren Buffett’s investment in Apple is a prime example of the importance of Free Cash Flow. When Buffett invested in Apple during 2016-2017, the company’s Free Cash Flow Yield (FCFY) was around 8-9%. This figure means that even if Apple didn’t grow, 8-9% of the investment would consistently accumulate in the company’s bank account.

Buffett focused on Apple’s stability rather than its growth potential. He was confident that Apple would continue to generate cash steadily, and as a result, Apple’s stock performed far beyond his expectations.

Conclusion: The Confidence That Simple Metrics Bring

Free Cash Flow is an essential indicator for assessing a company’s future profitability. By eliminating complex accounting jargon and focusing on Free Cash Flow to understand a company’s true value, investors gain confidence. Warren Buffett’s successful investments were also based on such straightforward metrics.

If you want to succeed in investing, it’s crucial to find companies that generate stable profits by analyzing simple indicators like FCFY. The same applies in life: identifying the core in complex situations and choosing a stable direction is ultimately the quickest path to success.