Understanding Fear

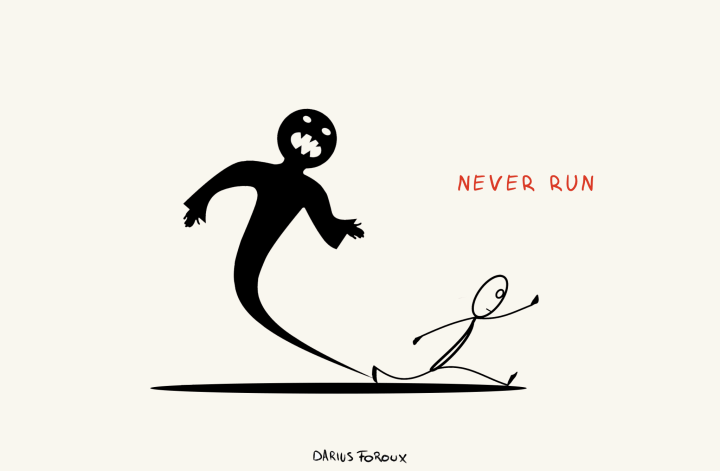

Money and fear are inseparable for many people. They fear losing the money they have or worry about not earning enough in the future. This fear is a natural response but can be a significant barrier to building wealth.

When starting to invest, many people feel fearful. I too experienced significant losses when I first began investing. Losing two-thirds of my entire savings was a painful experience that made me fearful of investing again.

However, avoiding the stock market due to this fear means avoiding any risk. Building wealth always involves risk, whether in stocks, real estate, or entrepreneurship.

Often, we are too fearful. As a result, we either do not invest at all or do so insufficiently.

Ultimately, we leave a lot of money on the table.

Common Traits of Successful Investors

Many of the world’s wealthiest people have built their fortunes through stocks. Think of Warren Buffett, Jeff Bezos, and Elon Musk. All of their wealth was created through the stock market. We too can invest in stocks, but we often feel afraid.

What if I lose money?

What if there’s a recession?

What if the dollar crashes?

What if another war or pandemic occurs?

These thoughts are common. Especially when spending time on social media, it can feel like the world is about to end. However, look at the last 100 years. Despite world wars, natural disasters, recessions, pandemics, currency issues, elections, and social unrest, the stock market has continued to rise. None of these events could be prevented.

Wisdom of Stoic Philosophy

To build long-term wealth, you must overcome the fear of losses. In passive investing, losses are only temporary. Marcus Aurelius spoke about time as follows:

“Time is like a river made up of events which happen, and its current is strong; no sooner does anything appear than it is swept past, and another comes in its place, and this too will be swept away.”

The stock market is similar. No matter what happens in the world, the stock market is like a continuously flowing river. Sometimes the current is faster or rougher, but the river always flows in the same direction. The stock market experiences ups and downs but continues to rise overall.

These fluctuations are natural. They are temporary. Accepting this characteristic makes the fear of investing disappear. By reducing the daily movements to a smaller scale, we realize that not investing costs more.

This is the main lesson of Stoic philosophy. Do not fear what is natural. Combine the skill of managing fear and greed to become a more consistent investor.

Conclusion

Investment is a process of overcoming fear. Stoic philosophy helps us control our minds and overcome fear. To build long-term wealth through investment, we must move beyond fear. Understand your fear and have the courage to overcome it.

References: Darius Foroux, “Stoic & Wealthy #2: On fear”