The stock market is constantly changing. While the S&P 500 Index is reaching record highs, not all stocks are following this trend. In particular, with large tech stocks dominating the market, interest in small-cap stocks is growing. But why should we pay attention to small-cap stocks? Let’s explore the reasons and strategies for investing in small-cap stocks.

Valuation Gap Between Large-Cap and Small-Cap Stocks

One of the key metrics investors use to evaluate stocks is the Price-to-Earnings Ratio (P/E Ratio). The P/E Ratio indicates how much you pay for each dollar of earnings a stock generates. Recently, the S&P 500’s P/E ratio stands at 21.3 times, while the S&P 600’s is only 13.9 times. This gap is the largest since the dot-com bubble in 2001. This suggests that small-cap stocks are undervalued compared to large-cap stocks.

Historical Performance of Small-Cap Stocks

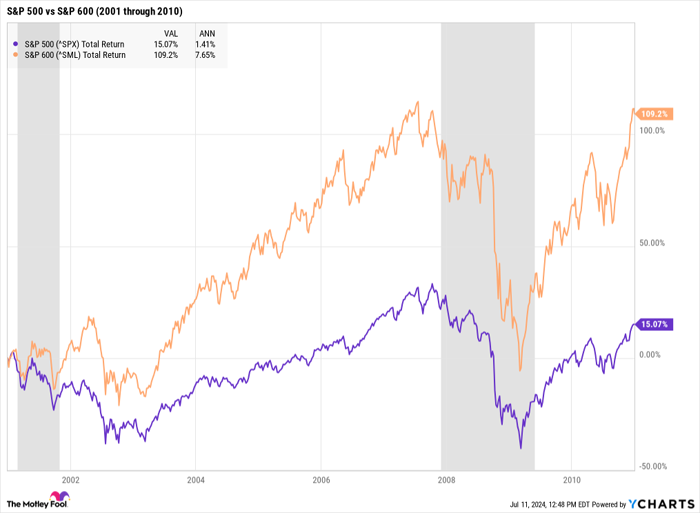

Historically, small-cap stocks have delivered higher returns than large-cap stocks. For instance, between 2001 and 2005, the S&P 600 Index had an average annual return of 10.8%, while the S&P 500 Index returned only 2.8%. Even after the financial crisis, small-cap stocks outperformed large-cap stocks.

Reasons to Invest in Small-Cap Stocks

In recent years, small-cap stocks have lagged behind large-cap stocks for several reasons.

- Rising interest rates have made it difficult for small-cap stocks, which often rely heavily on debt, to grow.

- Investors have turned to safe bonds with a 5% risk-free return.

- Concerns about economic recession have led to a preference for larger companies.

However, this situation is changing. The Federal Open Market Committee (FOMC) has signaled possible interest rate cuts, and recession fears are easing. This is a positive sign for small-cap stocks.

How to Invest in Small-Cap Stocks

The simplest way to invest in small-cap stocks is through index funds. Notable examples include SPSM (SPDR Portfolio S&P 600 Small Cap ETF) and IWM (iShares Russell 2000 ETF), which tracks the Russell 2000 Index. You can also invest through funds like AVUV (Avantis U.S. Small Cap Value ETF).

Conclusion

Now is a good time to consider investing in small-cap stocks. As market dynamics shift, small-cap stocks have the potential to attract renewed attention. Consider adding small-cap stocks to your investment portfolio! Small-cap stocks offer a different appeal compared to large-cap stocks and can provide higher returns in the long run.

In stock investing, it’s crucial to approach with a strategic mindset based on diverse information. Enhancing your understanding and interest in small-cap investments can lead to better investment decisions.

Reference: Motley Fool, “The Stock Market Is Doing Something Unseen Since the Year 2000. History Says This Happens Next.”