Have you heard of cyclical stocks, also known as “cyclical shares”? Cyclical stocks refer to stocks whose performance fluctuates with the economic cycle. Many investors believe these stocks are highly sensitive to market volatility, but in reality, they often yield higher returns over the long term compared to defensive stocks. So, how can you identify cyclical stocks and achieve maximum returns?

Cyclical Stocks vs. Defensive Stocks

First, it’s important to understand the difference between cyclical stocks and defensive stocks. Cyclical stocks perform better during periods of rapid economic growth but tend to underperform during economic slowdowns. On the other hand, defensive stocks provide stable performance regardless of the economic situation.

Yale University Research: GDP and Stock Returns

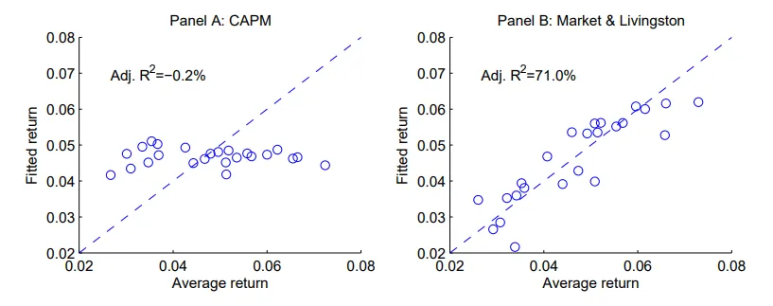

Will Goetzmann of Yale University and Akiko and Masahiro Watanabe of the University of Alberta proposed a new method to measure the cyclicality of U.S. stocks. They regressed the excess returns of stocks over the market against market beta and predicted GDP growth rates. This approach showed that adding GDP predictions could explain 71% of the variation in stock returns.

CAPM Model and GDP Predictions: The Difference in Returns

The traditional CAPM model does not fully explain the variability in stock returns. However, the new model that incorporates GDP predictions allows for more accurate forecasts. In other words, a model including GDP predictions explains the variation in stock returns much better.

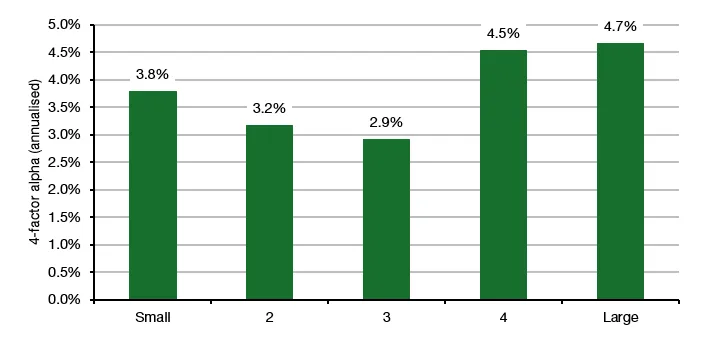

Classifying Stocks by GDP Sensitivity

When stocks are classified based on size and GDP sensitivity, it is evident that those most sensitive to GDP have higher returns. This phenomenon is particularly noticeable in large-cap and value stocks.

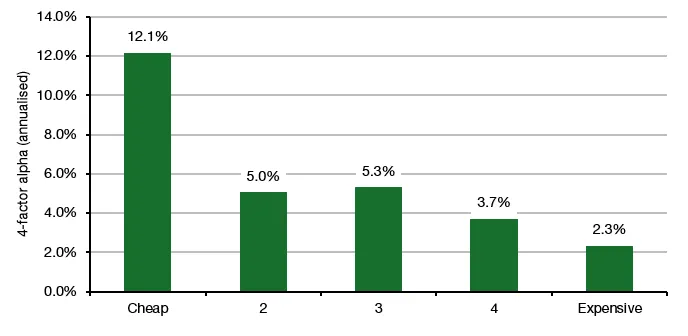

In the Case of Value Stocks

Among value stocks, those with high cyclicality tend to outperform those with lower cyclicality. Specifically, stocks with low valuations and high GDP dependency tend to perform better in the long run.

Conclusion: How to Invest in Cyclical Stocks

So, what should you buy? Choose stocks with low valuations and high cyclicality, and hold onto them for a long time. Of course, this investment approach can be psychologically challenging. However, if your goal is long-term returns, this strategy may prove effective.

Reference: Klement on Investing, “The superior returns of cyclical stocks”