There are important lessons to be learned even without watching the stock market closely. This story is based on the experience of Jason Zweig from The Wall Street Journal. He spent a long vacation away from the market, and as a result, gained significant insights.

Stepping Away from the Stock Market

Before Jason Zweig left for his long vacation, the S&P 500 index had already risen by 10.3% in 2023. He mentions that distancing himself from the market noise allowed him to gain a broader historical and psychological perspective. This was because he was no longer swayed by the daily volatility of the market.

The Folly of Market Predictions

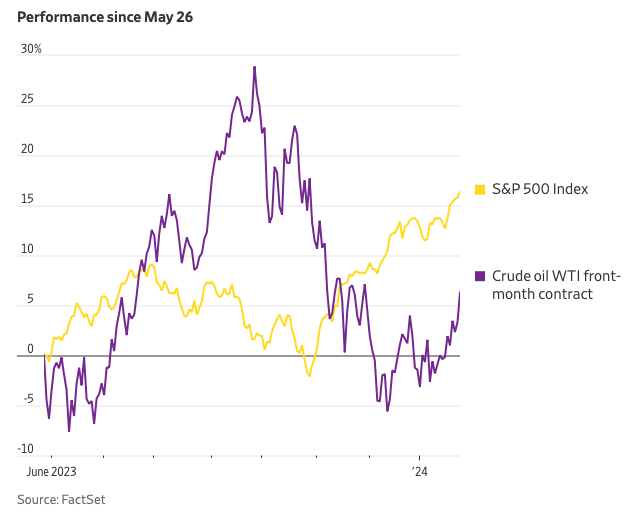

Zweig claims he was completely unaware of market changes during his five-month break. During that time, the S&P 500 index experienced significant drops and recoveries, and the 10-year Treasury yield also fluctuated greatly. He realized that most of his previous predictions were foolish, and that things became clearer when he distanced himself from the market noise.

Nvidia’s Surge

Before Zweig left for his vacation, Nvidia’s stock was already on the rise. He questioned the rapid surge driven by the AI boom, yet Nvidia continued to soar. This example demonstrates the importance of viewing the market with a long-term perspective rather than reacting to the news.

Middle East Conflict and Oil Prices

If one had predicted a war in the Middle East and a subsequent spike in oil prices, it would have seemed plausible. However, in reality, oil prices remained stable, which was unexpected. When unexpected events occur, it is important to respond calmly.

Mental Time Travel

Psychologist Hal Hershfield of UCLA proposes a tool to escape the tyranny of the present through mental time travel. This involves writing a letter to your future self. It is about imagining the outcomes of decisions made by your future self, rather than being swayed by current emotions.

Conclusion

Don’t be swayed by market predictions; focus on investing with a long-term perspective. Step away from the market noise and make your investment decisions with a calm mind. Engage in mental time travel to converse with your future self, and carefully consider today’s decisions. Imagining how your future self will view your current decisions is a highly beneficial approach.

Source: Jason Zweig, “What I Learned When I Stopped Watching the Stock Market”